The Future is Full of Opportunity

State of the U.S. Alcohol Import Industry

Is this a good time to get into the importing business?

Let's see what the data shows. We'll unpack the state of the industry and what you must know.

Free Alcohol Importer Toolbox

All the formulas and tools that Pro importers use to run a successful alcohol import business.

Start like a pro and avoid costly mistakes:

- Toolbox: Essential formulas and tools that professionals use to run their business.

- Startup Checklist: Step by step checklist to open and run your business.

- Essential Resources: Get access to tools, templates, and must-know regulations that will save you time and money.

Get it all Free for a limited time.

Get it FREE instantly!

The 2020 shutdown is over, and people are clinking glasses again. That fresh thirst is good news for anyone who brings in new bottles.

Today’s news shouts about tariffs and trade fights. It looks messy, but those bumps open lanes for quick movers who look past the noise.

Think back to the late ’90s. Newspaper print still ruled, and online news was tiny. A few years later, print giants went the way of the dinosaurs. Fortune changes hands in times of crisis. The same hand-off is starting now.

Big brands feel heavy and slow. Their grip is slipping. Clear-eyed newcomers can step in, fill the gaps, and become tomorrow’s leaders.

"Fortune Changes Hands in Time of Crisis"

Built-In Safety

It's important to realize that the alcoholic drinks business is pretty much recession proof. However, these days we might be seeing signs not only of health, but actual growth.

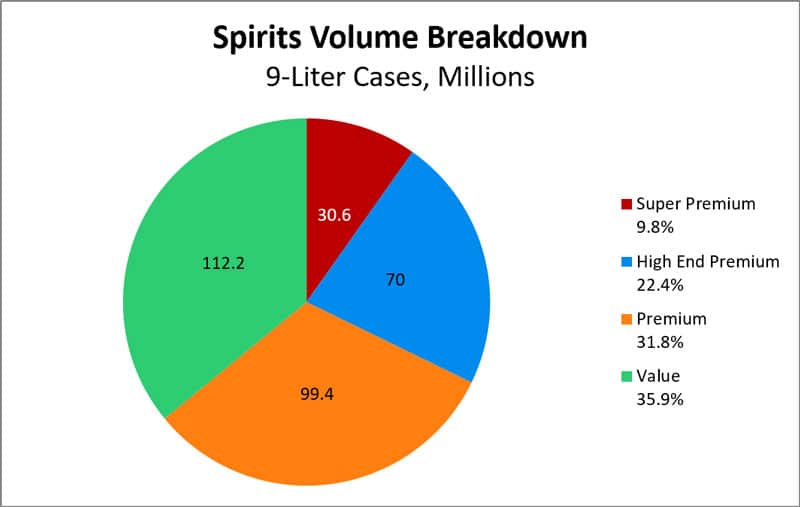

Here's just one example: Data show that spirits supplier volumes hit 312 million 9-liter cases in 2024, up 1.1 percent while most retail categories slipped.

And spirits are not alone. Bottles move when other goods stall—hard-wired resilience.

Paychecks Up, Pour-Time Up

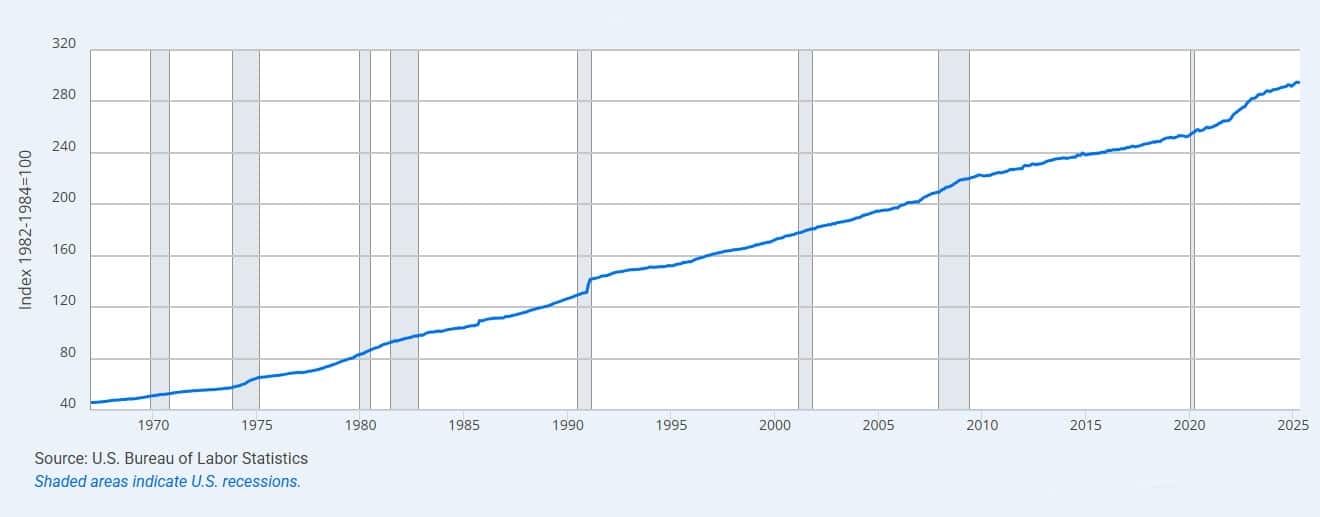

Average hourly earnings reached $36.24 in May 2025, +3.9 percent year-over-year. The Consumer Price Index report shows prices up only 2.3 percent.

So what does that mean?

It means consumers are left with a lot more “fun money” in their pockets. And where there's more "fun money" to play with, alcohol sales are sure to benefit.

This is great for the whole alcoholic drinks industry, but especially for new brands that are looking to get a piece of the market.

When people have "fun money" they tend to experiment more and search for stuff that's out of the ordinary. Smart importers can and should satisfy the consumer need for the "new."

| Month 2025 | Average Hourly Earnings — Total Private ($) |

|---|---|

| March | 36.02 |

| April | 36.09 |

| May | 36.24 |

Bars Need More Bottles

Restaurant and bar sales jumped 7.8 percent YoY in April 2025, yet the wholesale inventory ratio for beer, wine and spirits slid to a three-year low.

This opens up a lot of shelf space. The need to fill up the shelves presents opportunties for those that are prepared to take them.

This goes back to the point we made earlier that new market players, especially importers, have a unique opportunity to enter the market and grow.

"... new market players, especially importers, have a unique opportunity to enter the market and grow."

Profits Up

The overall alcohol CPI rose 1.8 percent, but the import price index for beverage spirits (HS 22) fell 2.4 percent year-over-year. Landing costs drift down, shelf tags creep up. This means each bottle poured fattens the slice of profit.

If you look at the Alcoholic Beverages trend for urban consumers (chart below) you see that it always goes up. However, note the serious bump after 2020 and going into 2025.

This increased demand ups the margins and creates more profits.

"... increased demand ups the margins and creates more profits."

Alcooholic Beverages in U.S. City Average

Tequila Takes the Lead

NIQ on-premise data show tequila as the only major spirit in value growth: +0.7 percent in U.S. bars and +1.4 percent worldwide. Premium pours grab the biggest bite—agave owns the spotlight.

But it's not a done deal, as we'll see next...

Tariff Whiplash

A February tariff threat of 25 percent on tequila sent brands racing to ship months of stock, then pausing new deals. Buyers now want steady, drama-free supply.

Oddly enough, the whole tarrifs drama did nothing more than increase demand for new brands in general.

As things start to settle down, new brands, most of them imported, will emerge and take advantage of the American consumer and their desire to try new things.

"... new brands, most of them imported, will emerge and take advantage"

Lanes Filling Fast

The need for new products will propel smart brands that are entering the market.

The Craft Spirits Data Project counts 3,069 active U.S. distilleries—up 11.5 percent in a year—while shelf space stays flat.

Having said that, most of the demand will be filled by imported products.

The Time Window

Built-in demand, rising wages, thin stock, tame inflation, cheaper imports, tequila heat, tariff tremors, and swelling competition converge right now.

As always, you can contact us with your specific importing situation. Just use the contact form here.

Also, you can get the free Alcohol Importer Toolbox - see details below.

Contact Us

Free Alcohol Importer Toolbox

All the formulas and tools that Pro importers use to run a successful alcohol import business.

Start like a pro and avoid costly mistakes:

- Toolbox: Essential formulas and tools that professionals use to run their business.

- Startup Checklist: Step by step checklist to open and run your business.

- Essential Resources: Get access to tools, templates, and must-know regulations that will save you time and money.

Get it all Free for a limited time.

Get it FREE instantly!

Ready to Start Your Alcohol Import business

Contact us with your specific situation at the number below or use the contact form.